Dealing with a loved one’s estate is an emotional and complex challenge. One of the biggest questions heirs face is whether they can sell an inherited house without getting stuck in Maryland’s lengthy and often expensive probate process. The answer is often yes, but it requires understanding specific legal pathways.

This guide focuses specifically on how to sell an inherited house without going through full probate. It’s a critical piece of the puzzle covered in our complete 2026 guide to selling an inherited house in Maryland, which provides the overarching strategy for a fast, stress-free sale. Here, we’ll dive into the specific exemptions and steps you can take to bypass the court system and sell your property quickly.

Key Takeaways

- 🏠 You can sell inherited house without probate Maryland when title passes via trust, joint tenancy, or a TOD deed Maryland.

- ⚖️ Maryland’s probate exemption Maryland options include the small estate affidavit MD (Est. & Tr. § 5‑601) for estates under $50k / $100k (spouse).

- ⏱️ Cash buyers such as Maryland Cash Home Buyers can close in 7‑21 days—no repairs, commissions, or delays.

- 💸 Lineal heirs pay 0 % inheritance tax; sellers only cover transfer & recordation fees.

Understanding Key Terms

Sell inherited house without probate Maryland: Use trusts, joint tenancy, TOD deeds, or a small‑estate affidavit to bypass probate—qualifying for a probate exemption Maryland and closing in as little as one week.

Probate —Maryland court process to validate a will, pay debts, and distribute assets; typically lasts 6–12 months and incurs legal costs.

TOD deed —A Transfer‑on‑Death deed that lets owners name beneficiaries; title vests automatically at death once recorded, circumventing probate (Est. & Tr. § 14‑113).

Step‑up basis —IRS rule that resets an inherited home’s tax basis to date‑of‑death value, reducing capital‑gains taxes (IRS Pub 559).

Table of Contents

- Understanding Probate Exemptions in Maryland

- Step‑by‑Step: Sell Without Probate

- Small‑Estate Affidavit Flowchart

- Maryland Taxes & Fees

- Maryland Success Stories

- Pros & Cons

- FAQs

- Ready to Sell?

- About the Author

Understanding Probate‑Free Paths in Maryland

Maryland allows several probate exemption Maryland strategies (Maryland Register of Wills FAQ): probate exemption Maryland strategies:

- Revocable living trust: trustee records deed to buyer.

- Joint tenancy with right of survivorship: surviving owner can sell immediately.

- TOD deed recorded in land records; passes title on death.

- Small Estate Affidavit for estates below statutory caps.

Step‑by‑Step: Sell Without Probate (How To)

1. Confirm Title Status

First, verify how the property title is held. Pull the deed from the Maryland Department of Assessments and Taxation (SDAT) online portal. Look for specific language indicating a revocable living trust, joint tenancy with right of survivorship, or a recorded Transfer-on-Death (TOD) deed. This language confirms your ability to sell without full probate.

2. Record New Ownership

Based on the title, file the necessary legal documents to officially transfer ownership. This may involve recording a trustee’s deed if the house is in a trust, a new deed as the surviving owner, or filing the completed small estate affidavit packet with the Land Records office in the county where the property is located.

3. Request Cash Offers

Contact reputable local investors who specialize in inherited properties. A cash buyer like Maryland Cash Home Buyers can provide a no-obligation, as-is offer within 24 hours, eliminating the need for repairs, showings, or agent commissions and often covering typical closing costs.

4. Close and Receive Funds

After accepting an offer, you can choose a settlement date that works for you, typically within 7 to 21 days. You will sign the final paperwork with a licensed title company and receive your proceeds directly via a secure wire transfer or a certified check.

While these steps cover the probate-free sale, you still need to manage other tasks like communicating with heirs and handling final taxes. To stay on track, follow our complete 10-step checklist for selling an inherited property in Maryland.

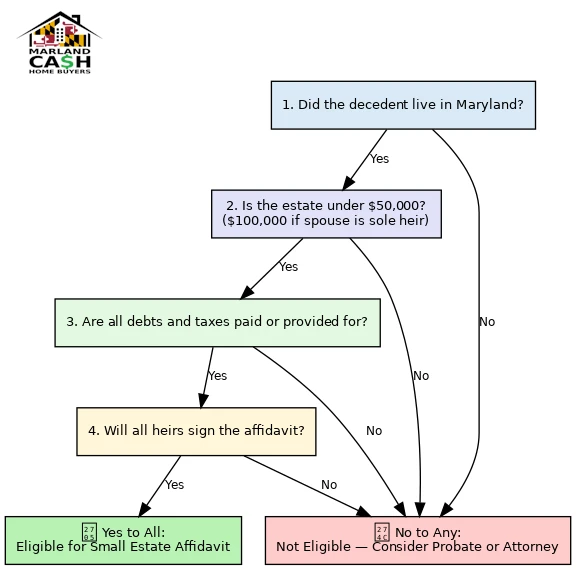

Small‑Estate Affidavit Flowchart

Dealing with a loved one’s estate can be overwhelming, especially when facing the complexities of probate. Fortunately, Maryland offers a Small Estate Affidavit as a simplified solution for transferring assets without the time and expense of formal probate. If the estate meets certain value thresholds and other requirements, heirs can use this affidavit to quickly access and distribute the deceased’s assets, saving time, money, and stress.

This flowchart visually guides you through the value thresholds, heir requirements, and debt checks to see if you qualify for Maryland’s small estate process.

Maryland Taxes & Fees

If you’re facing foreclosure on an inherited property, our Baltimore Foreclosure Step‑by‑Step Guide walks you through every option.

| Charge | Rate / Exemption | Payer |

|---|---|---|

| Inheritance Tax | 0 % lineal / 10 % others | Heirs |

| Transfer & Recordation | 1–1.5 % of sale price | Negotiable |

| Capital‑Gains Tax | Based on step‑up basis | Seller |

Maryland Success Stories

Brielle Walker’s Story

“Justin is lifesavers! Sold my vacant property in 5 days. No showings, no repairs—just a quick, sale.”

Brian Levi’s Story

“Maryland Cash Home Buyers provided me with a fair offer and closed the deal in just a few weeks. No repairs, no commissions—just fast and easy cash!”

Pros & Cons

- Pros

- 7‑21‑day cash closing

- No court bond or supervision

- Sell my house as‑is Maryland—no inspections

- Cons

- Documentation must be correct

- Family disputes can delay sale

- Liens must be satisfied at closing

A 60‑second Short covering probate‑free title tools and a real 7‑day cash‑sale timeline.

FAQs

What is the quickest way to sell an inherited house in Maryland?

A vetted cash buyer can close in as little as 7 days—no repairs, appraisals, or realtor fees.

Do I have to go through probate to sell an inherited house in Maryland?

No. Trusts, joint tenancy, TOD deeds, or a small‑estate affidavit let you bypass full probate.

How long does it take to sell an inherited house after probate in Maryland?

Expect 60–90 days once Letters of Administration are issued and a buyer is found.

Who pays the inheritance tax in Maryland?

Lineal heirs pay 0 %; non‑relatives pay 10 % on their share.

Can multiple heirs sign a TOD deed?

Yes. All owners may record a single TOD deed naming equal beneficiaries.

Is a small‑estate affidavit valid statewide?

Yes—file with the Register of Wills where the decedent lived; approvals average three weeks.

What documents do cash buyers require?

Photo ID, recorded deed or affidavit, payoff statements, and a recent utility bill.

Are closing costs cheaper without a realtor?

Yes; while you avoid the typical 6% commission, typical seller costs drop to taxes plus minimal title fees. For a detailed comparison of costs when selling to a cash buyer versus listing with a realtor, see our Cash Buyer vs Realtor Guide.

What happens to the mortgage when you inherit a house in Maryland?

An outstanding mortgage is one of the most pressing reasons to bypass probate. While you can often assume or refinance the loan, you must continue making payments to prevent foreclosure. This financial pressure makes a fast, probate-free sale highly attractive. For a complete strategy on this specific challenge, see our 6-step action plan for managing an inherited mortgage.

How do I avoid capital gains tax when selling an inherited property in Maryland?

The step‑up in basis resets the tax basis to market value at death, so you owe gains only on appreciation afterward. A tax professional can refine your strategy.

What if there are multiple heirs and we don’t agree on selling the house?

If heirs can’t agree, a partition action can force a court‑ordered sale and split proceeds. Mediation is a cheaper first step.

Expert Reviewed for Accuracy

To ensure you receive the most accurate and ethical guidance, the information on this page has been reviewed and verified by Debbi Rivero, a RE/MAX Master Agent with over 30 years of experience in the Maryland real estate market.

This is our commitment to providing you with trustworthy information so you can make a confident and informed decision.

Ready to Sell?

Request Your 24-Hour Cash Quote

Our quotes are always free, with no obligation. We guarantee our cash offer for 7 days—no bait-and-switch tactics. Close in as little as 7 to 21 days.

Not Ready to Sell?

Download Our Free Probate Quick‑Exit Checklist

This free, downloadable PDF provides a simple roadmap for heirs to navigate the key steps of selling an inherited property in Maryland.