Key Takeaways

- ✅ Multiple heirs inherited house Maryland issues can trigger probate delays, tax surprises, and family tension.

- ✅ How to sell inherited house with siblings without court: agree, sign one deed, and close in days.

- ✅ Three proven paths—sell & split, sibling buy‑out, or partition—plus expert tips to avoid lawsuits.

- ✅ Cash buyers close in 14‑30 days, pay closing costs, and spare you repairs or agent fees.

Dealing with a multiple heirs inherited house in Maryland can feel overwhelming: grief collides with paperwork, and every sibling has a different plan. This quick‑read guide shows you exactly how to keep the peace, protect your equity, and move on—together.

For a full guide on how to sell inherited property in Maryland, see our [2026 Inherited House Seller’s Guide]

🚀

Maryland co-heirs who put their agreement in writing cut inheritance disputes by

90% and can close up to 6 months faster than families that don’t (1).

Key Terms

Probate — the Maryland court process that transfers a deceased owner’s assets; expect 6‑12 months of oversight (1)

Step‑Up Basis — resets the home’s tax basis to market value at the owner’s death, slashing capital‑gains tax (2)

Partition Action — a lawsuit asking a judge to force a sale when co‑owners can’t agree; expensive, public, and slow.

Table of Contents

- Why Inheriting a House with Multiple Heirs in Maryland Gets Messy

- 3 Proven Paths to Peace

- Video Walk‑Through

- Resolution Options vs. Cost / Time / Stress

- Maryland Laws You Must Know

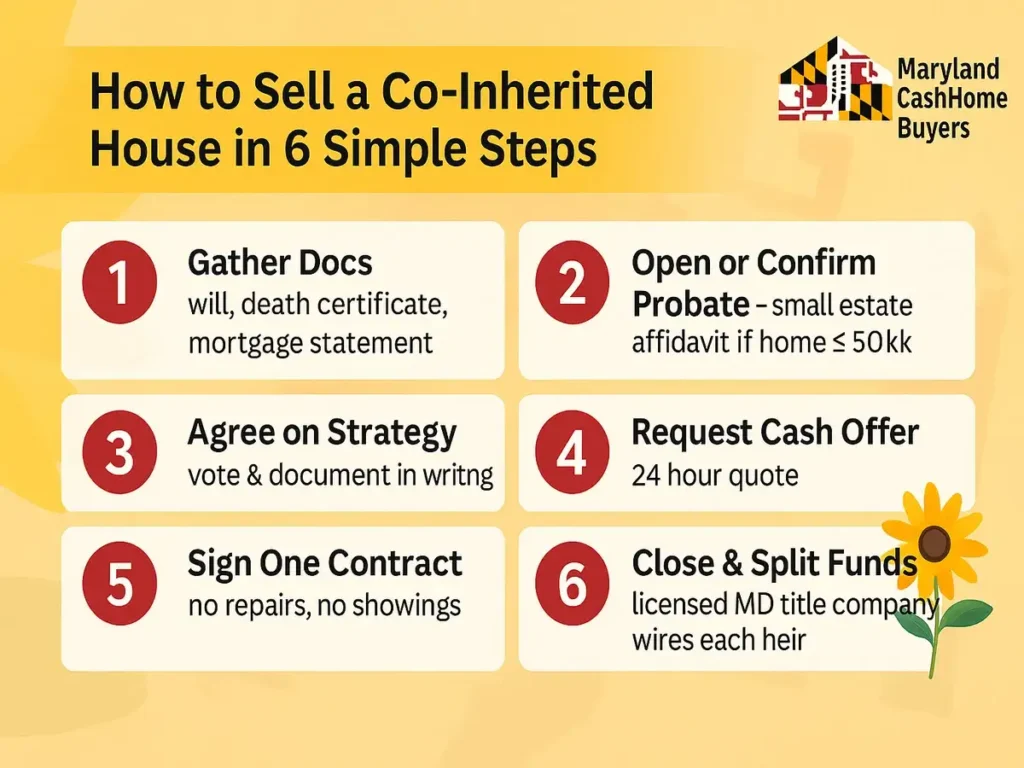

- How to Sell a Co‑Inherited House in 6 Simple Steps

- FAQ

- What Our Clients Say

- Limited‑Time Offer

- About the Author

- Get Your Cash Offer & Free Heir Checklist

- Sources

Why Inheriting a House with Multiple Heirs in Maryland Gets Messy

Why do sibling inheritances get messy in Maryland? Often, heirs have conflicting goals: one wants to rent Mom’s Baltimore row‑home, another needs fast cash for medical bills, and a third lives in California dreading repairs. It’s important to understand that even when Multiple Heirs Inherited House Maryland, Probate delays, unexpected tax burdens, and unclear communication can quickly turn an inheritance into a legal and emotional minefield. Contact us today for a fair cash offer and sidestep months of stress.

3 Proven Paths to Peace

1 Sell & Split Evenly

This is often the simplest path for co-heirs. The group’s biggest decision is choosing the right sales method. For a full breakdown of timelines, costs, and net profit of both options, see our complete Cash Buyer vs. Realtor guide for inherited homes. Once you agree on a path, you simply accept an offer, pay off any liens, and divide the net proceeds according to each heir’s share.

2 Sibling Buy Out

One heir refinances or uses savings to purchase everyone else’s equity—ideal when a single sibling wants to live in the home. Tip: Ask your lender about Maryland transfer tax exemptions for family buy outs.

3 Court Ordered Partition (Last Resort)

If talks stall, any co owner can file a partition action Maryland lawsuit. A judge forces a sale and splits proceeds after hefty fees. Solution: Try mediation or request a cash buyer offer first—both typically cost 80% less. This is especially relevant if Multiple Heirs Inherited House Maryland.

Inherited a House with Siblings in Maryland? AVOID Family Feuds! [3 Step Guide]

Watch & learn: This 60 second Short reveals the 3 step roadmap Maryland heirs follow to sell, buy out, or peacefully divide inherited real estate—without lawyers, showings, or family feuds.

Resolution Options vs. Cost / Time / Stress

| Option | Typical Cost | Timeline | Stress |

|---|---|---|---|

| Sell & Split to Cash Buyer | $0 closing fees | 14 30 days | ★ |

| Sibling Buy Out | Appraisal $400 $600 | 30 60 days | ★★ |

| Partition Action | $5k $20k+ | 8 18 months | ★★★★ |

Maryland Laws You Must Know

Understanding the legal framework is crucial when Multiple Heirs Inherited House Maryland.

Many families find themselves needing Clarity on This topic when Multiple Heirs Inherited House Maryland.

- Probate vs. Joint Tenancy: “Joint tenants with right of survivorship” bypass probate; “tenants in common” must wait for court approval (Md. Code, Real Prop. § 2 118; Estates & Trusts § 5 301) (3).

- UPHPA (2023): Maryland adopted the Uniform Partition of Heirs Property Act giving heirs first refusal rights before any forced sale (Md. Code, Real Prop. § 14 6B 01 et seq.) (4).

- Transfer Tax Exemptions: Family buy outs can avoid recordation & transfer tax up to 1.5% savings in Frederick County (Md. Code, Tax Property § 12 108(e)) (5).

Conflict Trigger → Solution

Rental-income dream vs. quick-cash need → compare 10-year rent yield to today’s cash offer.

Silent heir won’t sign → try mediation, then partition petition.

How to Sell a Co Inherited House in 6 Simple Steps

- Gather Docs – Assemble the will, death certificate, and any recent utility or tax bills. It is especially critical to locate the latest mortgage statement. If there’s an outstanding loan, all heirs must agree on how to continue payments to avoid foreclosure. For a clear roadmap on this specific issue, use our 6-step action plan for handling an inherited mortgage.

- Open or Confirm Probate – small estate affidavit if home ≤ $50k ($100k spouse).

- Agree on Strategy – vote & document in writing.

- Request Cash Offer – 24 hour quote.

- Sign One Contract – no repairs, no showings.

- Close & Split Funds – licensed MD title company wires each heir.

For a more detailed version of these steps that includes managing personal belongings and filing final taxes, use our complete 10-step selling checklist to guide you and your siblings through the entire process.

💡 Pro tip: Collect each heir’s W-9 early to avoid 1099 delays.

FAQ: Multiple Heir Property Questions

These are common considerations that appear when Multiple Heirs Inherited House Maryland:

How do I sell inherited property with siblings?

Agree in writing on a representative, price, and split, then either list the home or accept a cash buyer offer; Maryland law lets all heirs sign one deed at closing.

What steps should I take to sell an inherited house with my siblings?

1) Draft a family sale agreement, 2) get one neutral appraisal, 3) choose a listing agent or cash buyer, 4) sign a contract, 5) close and divide proceeds.

Can I force a sale if my siblings want to keep the house and I don’t?

Yes any heir can file a “partition in lieu of sale” action in Maryland Circuit Court, and the judge can order a public or private sale if no voluntary agreement is reached.

How can we fairly divide proceeds if we sell the inherited property?

Use each heir’s ownership percentage from the will (or intestate rules); closing attorneys wire each share after paying liens, taxes, and selling costs.

What’s involved in buying out a sibling’s share of an inherited home?

You’ll need an appraisal to set fair value, a new mortgage or cash to pay siblings, and a deed transfer; Maryland recordation & transfer taxes are often waived for family buy outs.

Do we have to open probate before we can sell?

Yes, unless the deed lists all heirs as joint tenants with right of survivorship. Otherwise the personal representative must have Letters of Administration from the Orphans’ Court.

Will we owe Maryland or federal capital gains tax?

Most heirs pay little to no capital gains tax because of the step up basis rule. Tax is only due on appreciation after the date of death.

Can one heir live in the house rent free until we sell?

Only if all co owners consent in writing. Otherwise the occupying heir may owe fair market rent or face eviction proceedings.

How is the property’s value determined for buy outs?

Maryland courts accept a licensed appraisal, a CMA from a real estate agent, or an agreement in writing by all heirs.

What Our Clients Say

“Justin made selling my Frederick home so easy! If you want to sell your house fast in Maryland without headaches, give him a call. He’s a reputable cash home buyer. Very professional and reliable!” 😊

– James Rayson (Facebook Review)

“Sold my Montgomery County home in 2 weeks! Maryland Cash Home Buyers is the real deal. Honest, efficient, and customer-focused. 10/10!” ⭐

– Boaz Kipruto (Google Review)

Expert Reviewed for Accuracy

To ensure you receive the most accurate and ethical guidance, the information on this page has been reviewed and verified by Debbi Rivero, a RE/MAX Master Agent with over 30 years of experience in the Maryland real estate market.

This is our commitment to providing you with trustworthy information so you can make a confident and informed decision.

Limited Time Moving Assistance Offer

Moving Assistance Offer: Get Up to $500 to Help You Relocate – Don’t Wait! Maryland Cash Home Buyers is currently offering up to $500 in assistance toward local moving services to make your transition as smooth as possible. This offer is only available for a limited time, so act quickly—especially if you are trying to figure out how to sell inherited house with siblings.

About the author: Justin Mitchell – Maryland Real Estate Solutions

Justin Mitchell is a Western & Central Maryland real estate investor who has helped families navigate probate home sales since 2020. Although he isn’t a licensed Maryland REALTOR®, his investment partners are—so you get investor speed backed by full agent expertise. When it comes to the question of how to sell an inherited house with siblings, he’s the guy to call.

Get Your Cash Offer & Free Heir Checklist

- Ready to cash out? Get your instant cash offer.

- Need more clarity? Download our free Maryland Heir Checklist.

- Prefer to talk? Call Justin direct at (240) 693-5776.

- Get your full 2026 inherited house guide here