This article is for informational purposes and is not a substitute for professional legal or financial advice.

Full Transparency: Maryland Cash Home Buyers is a real estate investment company. While our primary goal is to provide the most comprehensive, educational resources for Maryland heirs, this article may also present our company’s services as a potential solution. Our content is free, but we are a for-profit business. We are committed to providing accurate, unbiased information to help you make the best decision for your unique situation.

Need the quick version? Call the servicer, file probate, decide keep/rent/sell — details below.

Inheriting a loved one’s home can feel like a blessing—until you discover the outstanding mortgage, monthly bills, and probate paperwork piling up on your kitchen table. As a Maryland heir myself, I understand that mix of grief and anxiety you may be feeling right now. In the next few minutes, you’ll get a crystal-clear, six-step roadmap. This guide is a crucial part of our comprehensive guide to selling an inherited house in Maryland, focusing specifically on the challenges of an outstanding mortgage and showing you exactly how to keep the lender at bay, prevent family rifts, and protect your financial future.

Key Takeaways: Your Immediate Next Steps

- Call the servicer within 30 days to let them know you are the heir; this pauses collection calls.

- Keep making the current payment (if affordable) to avoid late fees, foreclosure filings, and potential credit damage. A single 30-day late payment can drop a credit score by up to 100 points.

- File Maryland probate paperwork (small or regular estate) with the county Register of Wills.

- Gather sibling consent early—written agreements today prevent disputes tomorrow.

- If the loan is already in default: Do not ignore the notices. Request a Timeline & Eligibility Review immediately to see if you can resolve the debt before legal fees consume your remaining equity.

A Note From Your Guide, Justin Mitchell: As a Maryland investor who has personally helped dozens of families through this exact process, my goal is to give you the clear, honest information you won’t get from a bank or realtor. Let’s walk through this together.

Table of Contents

- Watch: A 60-Second Overview of Your Rights & Options

- Key Takeaways: Your Immediate Next Steps

- Key Maryland Inheritance & Mortgage Terms Explained

- The 6-Step Action Plan for Your Inherited Maryland Property

- Understanding Maryland’s Probate Timelines

- Decision Matrix: Comparing a Traditional Sale vs. a Cash Sale

- How We’ve Helped Maryland Families in Your Situation

- Frequently Asked Questions About Inherited Mortgages in MD

- About Your Guide, Justin Mitchell

- What’s Your Next Step? Choose the Path That’s Right for You

Watch: A 60-Second Overview of Your Rights & Options

Still wrapping your head around everything? This quick video explains the essentials before we dive deeper.

This 60-second guide covers your three main paths—assuming the loan, renting it out, or selling fast for cash—and explains the federal law that protects you from the bank demanding immediate payoff.

Key Maryland Inheritance & Mortgage Terms Explained

| Term | Simple Definition |

|---|---|

| Due-on-Sale Clause | A clause in most mortgages that lets a lender demand full payoff if the property transfers. |

| Garn-St Germain Act | A 1982 federal law that prohibits lenders from enforcing the due-on-sale clause when a borrower dies and the home transfers to a relative, as long as you keep making payments. |

| Probate | The Maryland court process that verifies wills, appoints a personal representative (PR), and authorizes home transfers. |

| Mortgage Assumption | A formal process—optional in Maryland—where you take over the loan in your own name, often without new underwriting. |

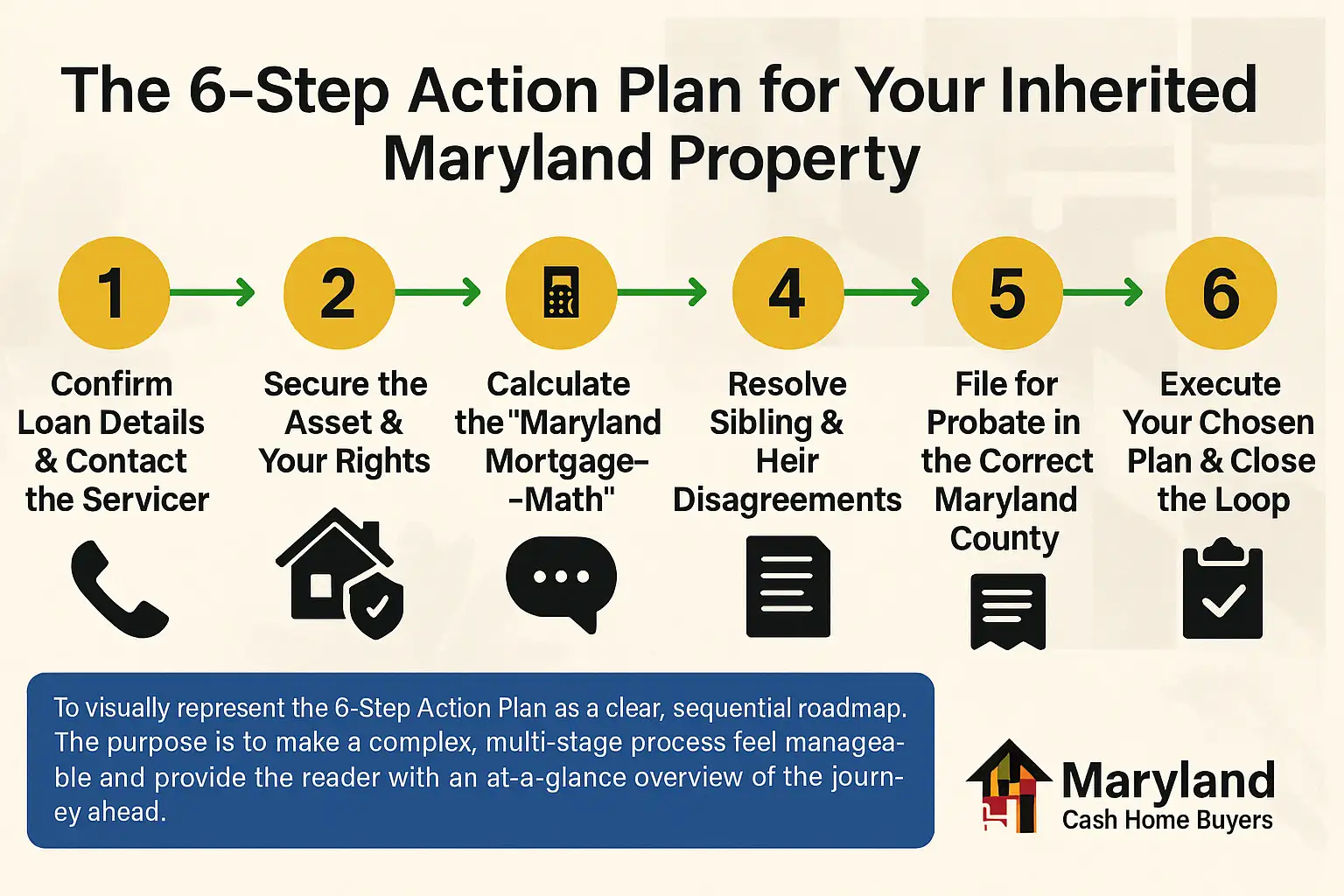

The 6-Step Action Plan for Your Inherited Maryland Property

This step-by-step plan is designed to take you from a state of uncertainty to one of empowered action. Follow these steps in order to ensure a smooth and predictable process.

Step 1: Confirm Loan Details & Contact the Servicer

Call the mortgage servicer’s loss-mitigation line, identify yourself as the heir, and request a payoff or reinstatement figure. Under CFPB rules, they must provide it within 7 days.

How to Request a Mortgage Payoff Figure in Maryland

As a confirmed “successor in interest,” you have a clear federal right to request a mortgage payoff statement. This is not a courtesy from the lender; it’s a legal requirement outlined in the Code of Federal Regulations. To exercise this right, submit a formal written request to your mortgage servicer providing proof of your status as an heir.

Step 2: Secure the Asset & Your Rights

Vacant homes attract vandals. Forward mail, switch utilities to the estate, and inform the insurer that the owner has passed to maintain coverage.

Step 3: Calculate the “Maryland Mortgage-Math”

Determine your path forward: Keep, Rent, or Sell. If the mortgage is current, you have flexibility. However, if the account is in arrears, we utilize our Pre-Foreclosure Resolution Program™ to run a “Timeline Triage.” This determines if you have sufficient time for Path B (a Retail Listing with Debbi Rivero) to maximize equity, or if Path A (Immediate Buyout) is required to satisfy the bank before a scheduled auction.

Step 4: Resolve Sibling & Heir Disagreements

When multiple heirs are involved, emotions can run high and disagreements are common. The key is to establish clear communication and document every decision. Hold a family meeting to discuss expectations around price, timeline, and responsibilities like cleaning out the property. If you hit a stalemate, remember that mediation costs far less than a circuit-court partition lawsuit. For a detailed walkthrough of these difficult conversations, see our comprehensive guide to navigating co-heir property issues.

Step 5: File for Probate in the Correct Maryland County

If the net estate is under $50,000 (or $100,000 for a surviving spouse), you may qualify for Maryland’s faster “Small Estate” track. Larger estates follow the “Regular Estate” path. You must file this paperwork with the Register of Wills in the county where the deceased resided.

Step 6: Execute Your Chosen Plan & Close the Loop

Once the property is sold or the title is transferred, file the final account with the Register of Wills and send the payoff confirmation to the mortgage servicer. This final step officially closes the estate’s responsibility for the property, freeing you from the burden.

Understanding Maryland’s Probate Timelines

Navigating the probate process is often the longest part of handling an inherited property. “Small Estate” cases can often be resolved in about 60–90 days, whereas “Regular Estate” files typically span 6–12 months due to stricter accounting and creditor claim periods. Understanding these timelines is crucial for managing the mortgage payments. In some cases, there are legal ways to transfer property with less court involvement. To see if your situation qualifies, explore our guide to selling a house without probate.

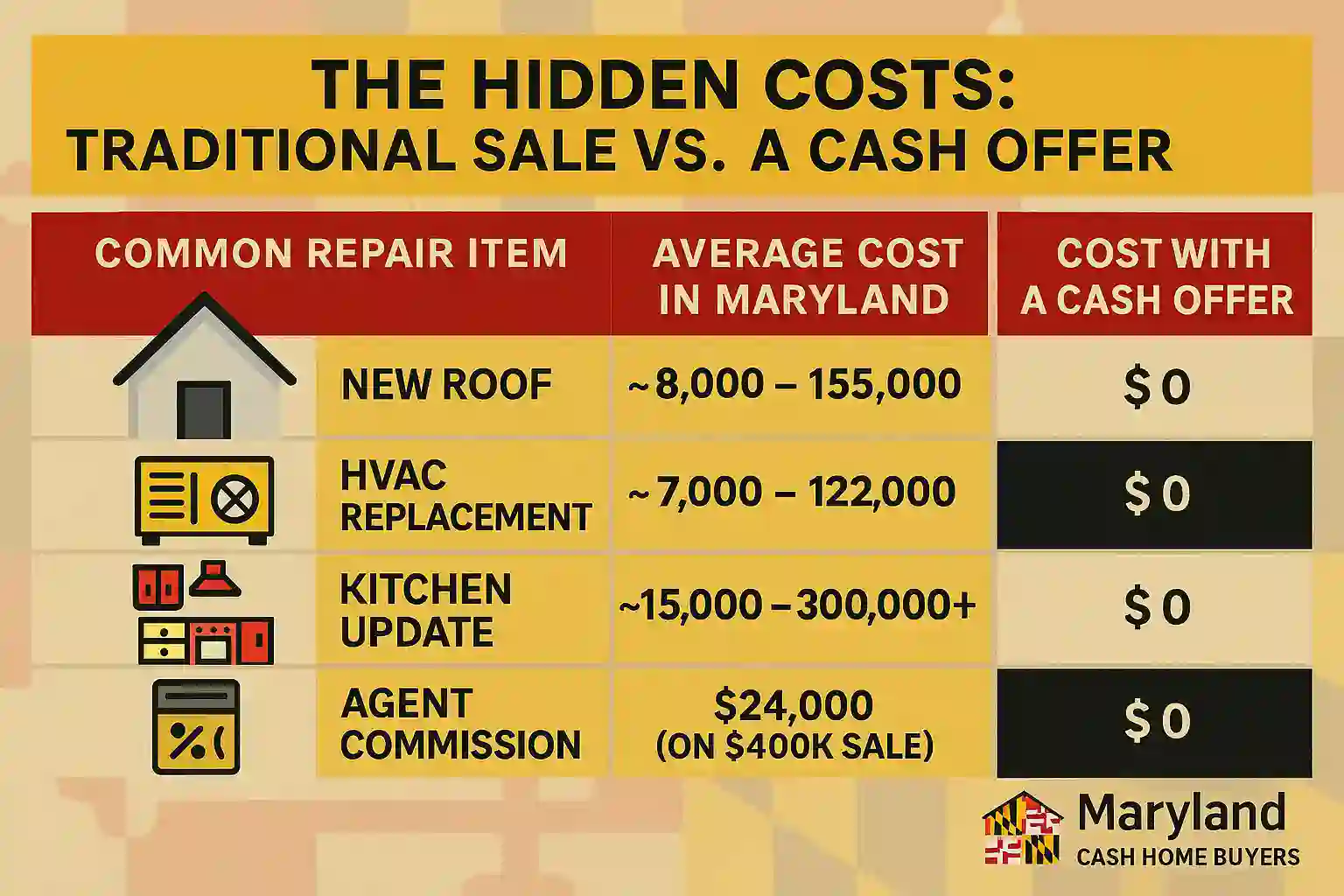

Decision Matrix: Comparing a Traditional Sale vs. a Cash Sale in Maryland

Once you decide to sell, you face another major choice: list with a realtor or sell directly to a cash home buyer. Each path has significant trade-offs in time, money, and stress. The table below is designed to help you objectively compare these two options, and for a deeper analysis, review our full guide on weighing a cash buyer vs. a realtor.

| Factor | Traditional MLS Listing | Cash Home Buyer (Maryland Cash Home Buyers) |

|---|---|---|

| Time to Close | 60–90 days after an offer is accepted | 7–21 days from initial contact |

| Repairs Needed | Yes—often $10k+ to be market-ready | None (we buy completely as-is) |

| Showings & Appraisal | Multiple showings; lender appraisal required | 1 brief walkthrough; no appraisal needed |

| Commissions / Fees | 5%–6% realtor fees + 1%–3% closing costs | $0 fees or commissions; we cover closing costs |

| Risk of Falling Through | 14.6% of pending sales fell through in May 2025 (AP News/Redfin) | Significantly lower; research suggests a 5-15% range (Aggregated Data) |

| Best For | Heirs who value maximizing price and have time and money for repairs. | Heirs who value speed, certainty, and avoiding repairs. |

How We’ve Helped Maryland Families in Your Situation

Here’s what recent clients say about our inherited-property service:

★★★★★ (5/5 Stars)

“Justin helped me sell my Rockville house for cash in under a month. The process was simple, fast, and stress-free. Maryland Cash Home Buyers is the real deal!” –

Erick N., Rockville, MD

★★★★★ (5/5 Stars)

“Sold my Germantown home in weeks! Maryland Cash Home Buyers is a lifesaver. No commissions, no listing—just fast cash and friendly service!” –

Isabella G., Germantown, MD

Frequently Asked Questions About Inherited Mortgages in MD

1. Can the bank demand full payoff after my parent’s death?

No. The federal Garn-St Germain Act protects transfers to a relative. As long as you keep the loan current, the lender cannot invoke the due-on-sale clause.

2. Do I have to go through probate if I’m the only heir listed on the deed?

Yes. Maryland law still requires probate to officially transfer title unless the deed is held in a living trust or includes a life-estate or Transfer on Death (TOD) designation.

3. How do I assume the mortgage in my own name?

Contact the servicer’s assumption department. You will typically need to submit proof of heirship (like the Letters of Administration from probate) and pay a modest processing fee. Approval usually take 30-60 days.

4. What if my siblings disagree on selling?

Try mediation first. If that fails, the estate’s Personal Representative can petition the court for a court-ordered sale to resolve the dispute and satisfy the estate’s obligations.

5. Will I owe Maryland inheritance or estate taxes?

Maryland’s 10% inheritance tax is waived for direct lineal heirs (children, parents, spouses) and siblings. The state’s estate tax exemption is $5 million in 2025. For a more detailed breakdown, you can learn more about understanding Maryland’s inheritance tax vs. capital gains tax. Always consult a tax professional for advice specific to your situation.

Expert Reviewed for Accuracy

To ensure you receive the most accurate and ethical guidance, the information on this page has been reviewed and verified by Debbi Rivero, a RE/MAX Master Agent with over 30 years of experience in the Maryland real estate market.

This is our commitment to providing you with trustworthy information so you can make a confident and informed decision.

About Your Guide, Justin Mitchell

I’m not just an investor; I’ve been in your shoes. Here’s a bit more about me and my team.

Justin Mitchell is a Western & Central Maryland real-estate investor who has helped families navigate probate home sales since 2020. Although he isn’t a licensed Maryland REALTOR®, his real estate investing partners are—so you get investor speed backed by full agent expertise. When it comes to sell inherited house Maryland, he’s the guy to call. Connect with Justin on LinkedIn or X (formerly Twitter).

What’s Your Next Step? Choose the Path That’s Right for You

You’ve seen every option on the table, and you are now in control of the situation. To make sure you execute your plan perfectly, don’t forget to grab our detailed inherited house checklist. When you’re ready to act, choose the path below that best fits your needs:

Option 1: For the Planner – Get Your $500 Moving Credit

Feel most comfortable with a plan? If you choose to sell your inherited house to us, we’ll give you a voucher for $500 to help with moving expenses or other costs.

📥 Get Your $500 Credit Voucher

Option 2: For Those With Questions – Talk to an Expert

Still have questions about your specific situation? Schedule a free, no-pressure consultation call to get the clarity you need from an expert.

📞 Schedule a Free, No-Obligation Call or simply call Justin directly at (240)-693-5776.

Option 3: For Those Ready for a Solution – Get a Fast Cash Offer

If your priority is a fast, simple, and certain sale, let’s skip the stress. Get a no-obligation cash quote in 24 hours and close on the day of your choice.