Last Updated: June 26, 2025

On This Page:

- An Introduction for Maryland Heirs

- Key Takeaways (3-Minute Guide)

- Key Terms to Know

- 60-Second Video Primer

- The Complete 10-Step Checklist

- Supporting Data & Cost Breakdowns

- Real Seller Success Stories

- Frequently Asked Questions

- A Final Word of Advice

- About Your Guide

- Choose Your Next Step

A Roadmap for Maryland Heirs

Inheriting a house in Maryland is a major life event, but it often feels less like a gift and more like a second full-time job. From probate paperwork to anxious co-heirs and mounting maintenance bills, the process can be emotionally exhausting and logistically complex.

Selling an inherited house in Maryland involves many steps, from handling probate to managing family communication. This complete 10-step checklist provides a clear roadmap for every task, helping you stay organized and navigate the sale with confidence to avoid costly mistakes.

Key Takeaways: Your 3-Minute Guide

- Probate first, sale second: Maryland courts must issue Letters of Administration before a deed can transfer.

- Stepped-up basis saves taxes: Your “gain” is calculated from the home’s fair market value on the date of death, not when Grandma bought it.

- All heirs must agree: Unified consent avoids lawsuits and keeps closing dates on track.

- Two selling paths: List and repair for 3–6 months or choose a direct cash sale for your Maryland house for a fast, as-is closing.

- Keep the lights on: Ongoing mortgage, insurance, and utility payments protect equity until the day you close.

Key Terms to Know

Probate: The official court-supervised process in Maryland for validating a will and settling an estate.

Personal Representative (or Executor): The person named in the will who is legally responsible for managing the estate.

Intestate: The term used when someone passes away without a valid will.

Stepped-Up Basis: A tax rule that resets the property’s value to its fair market value at the date of death, dramatically reducing capital-gains tax for heirs.

Your 60-Second Primer: 3 Steps You Can’t Afford to Skip

Watch this quick overview before diving into the checklist below.

In less than 60 seconds, you’ve learned the three most critical first steps every Maryland heir should take. Focusing on documents, the property’s true condition, and your tax status upfront helps prevent common delays with probate and avoids financial surprises down the road. The full 10-step checklist below expands on this foundation, guiding you through the entire process with confidence.

Your Complete Selling Inherited Property Checklist (Maryland)

This checklist is your roadmap. Each step is designed to address a common challenge, from navigating the legal system to managing family dynamics. Whether you’re trying to sell an inherited house with multiple heirs, exploring options to sell a house without probate, or simply deciding between a cash buyer vs. a realtor, this guide provides the clarity you need.

The journey of selling an inherited property in Maryland can feel complex, but it becomes much simpler when broken down into clear, actionable steps. This comprehensive selling inherited property checklist maryland guide is designed to be your guide from the very first day to the final sale. For each task, we explain why it’s critical for a smooth process and help you understand whether it’s a step you can handle yourself or if you’ll need a professional.

Follow the tasks in our selling inherited property checklist maryland below to keep your sale (and sanity) on track:

| Step # | Task | Why It Matters (To Avoid Delays & Costs) | DIY or Pro? |

|---|---|---|---|

| 1 | Secure the Property & Find Documents | Protects against theft and proves ownership with the will/deed. | DIY |

| 2 | Contact All Heirs & Communicate Clearly | Consensus prevents disputes that can freeze the sale. | DIY |

| 3 | Consult a Maryland Probate Attorney | Keeps your sale out of legal gridlock from the start. | Professional (Highly Recommended) |

| 4 | Petition for Probate & Get Letters of Administration | Unlocks your legal authority to sign contracts and sell. | Professional (Attorney handles) |

| 5 | Get a Formal Property Appraisal | Sets the stepped-up basis to minimize capital-gains tax. | Professional (Licensed Appraiser) |

| 6 | Inventory & Settle Estate Debts/Liens | Debts must be cleared before heirs receive proceeds. | DIY / Executor |

| 7 | Manage Personal Belongings | Allows family to claim sentimental items respectfully. | DIY |

| 8 | Maintain the Property | Pay mortgage, utilities, & insurance to protect equity. This step is critical; our detailed 6-step action plan for an inherited mortgage shows you exactly how to prevent foreclosure. | DIY |

| 9 | Analyze Your Selling Options (Realtor vs. Cash Buyer) | Traditional sale = 3–6 months & repairs; cash sale is fast & as-is. | DIY (Decision) |

| 10 | File Final Taxes for the Estate | Officially closes the estate and prevents future IRS penalties. | Professional (CPA) |

Data Breakdowns: Documents, Costs & Taxes

Essential Documents You’ll Need

The Maryland probate process runs on paperwork. Having the right documents ready from the start is the single best way to ensure a smooth and fast sale. This part of our selling inherited property checklist maryland is crucial; use this matrix to gather everything you need and avoid getting stalled by a missing form.

| Document | Where to Find It | Avg. Processing Time (MD) | Potential Fee |

|---|---|---|---|

| Death Certificate | MD Dept. of Health / Funeral Home | 1–3 Weeks | ~$25 |

| Last Will & Testament | Personal Files / Attorney | Immediate | $0 |

| Letters of Administration | County Register of Wills | 2–8 Weeks | Varies |

| Property Deed | County Land Records | 1–5 Days | ~$10–50 |

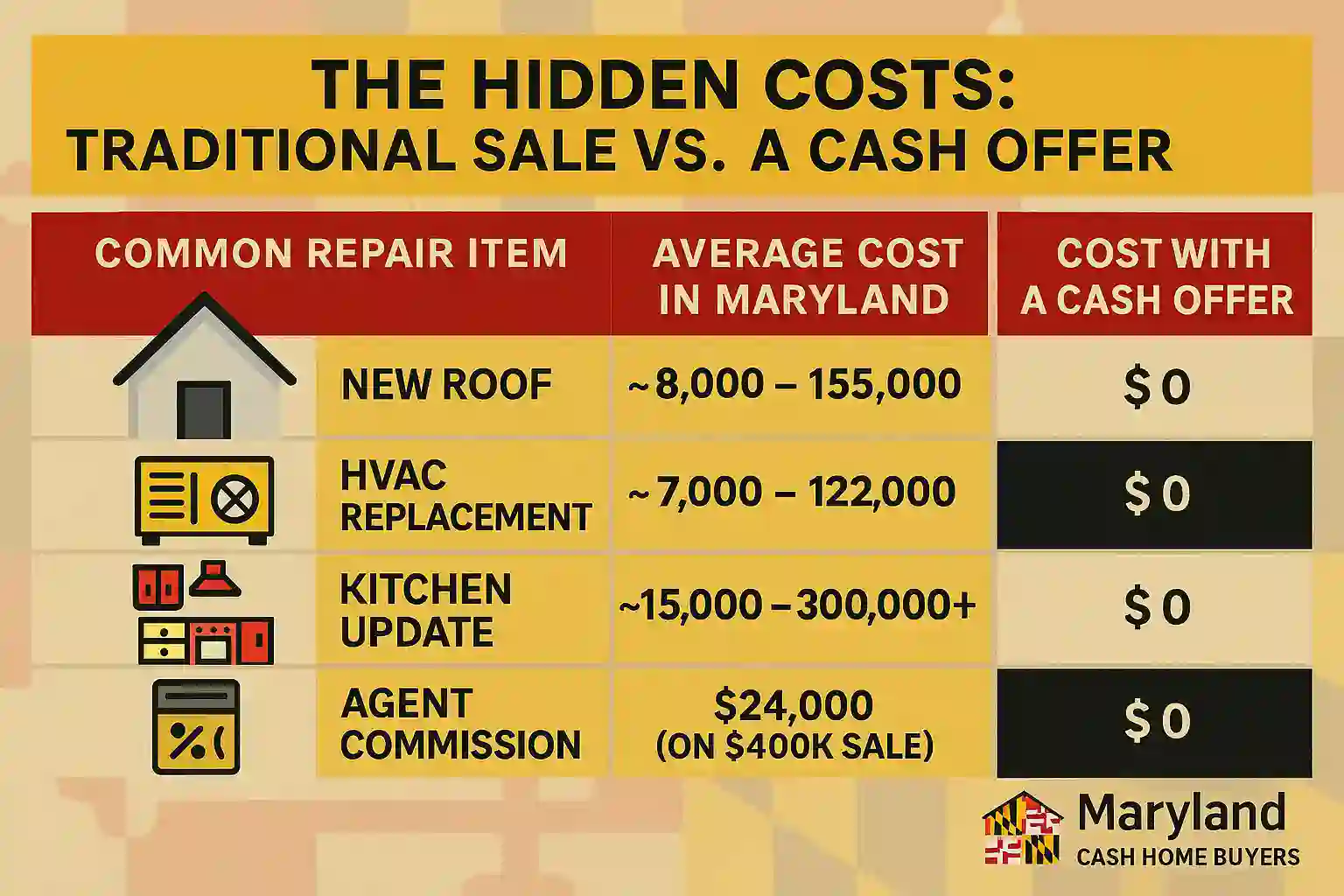

The Hidden Costs: Traditional Sale vs. a Cash Offer

One of the biggest financial shocks when selling a house the traditional way is the staggering cost of repairs needed to get it market-ready. These pre-sale expenses can easily eat into your inheritance and cause major delays. The infographic below illustrates the common costs you can completely bypass when you follow this selling inherited property checklist maryland and choose a direct cash offer. This is possible because our cash offer process is designed to buy homes in any condition, saving you time and money.

Maryland Inheritance & Estate Tax at a Glance

Taxes are one of the biggest sources of anxiety for heirs, but the good news is that Maryland’s rules are often more favorable than people think. For a complete breakdown of your tax obligations, please read our detailed guide on inherited property tax in Maryland.

For even more granular legal information, you can review these Maryland inheritance tax details from a local estate attorney. For now, this simple table breaks down the three main taxes involved—inheritance, estate, and capital gains—so you can understand your potential obligations and plan with confidence.

| Tax Type | Who It Applies To | Key Takeaway |

|---|---|---|

| MD Inheritance Tax | Distant relatives & non-relatives | Direct heirs (children, spouse, siblings) are EXEMPT. You can find more information on the official Maryland tax guidance page. |

| Federal Estate Tax | Estates >$13 million | Most inherited homes fall far below this threshold. |

| Capital Gains Tax | You, if you sell for a profit | You’re taxed only on gains above the stepped-up basis. The IRS provides an overview of capital gains on its website. |

How We’ve Helped Maryland Heirs Like You

“I was drowning in mortgage payments, but Maryland Cash Home Buyers helped me! Sold my Silver Spring house fast for cash. Honest and efficient!”

“If you’re in Columbia and need to sell fast, work with Justin! He made selling my house quick and effortless. Cash offer, no repairs—just results!”

Frequently Asked Questions from Maryland Heirs

Do all heirs have to agree to sell property in Maryland?

Yes—every legal heir must sign off, or the court can block the sale. If even one heir objects, you may need a court-ordered partition or buyout, both of which delay closing and increase costs.

How do I avoid capital gains tax when selling an inherited property?

Set and document the stepped-up basis with a professional appraisal. Then sell within a reasonable time to minimize appreciation beyond that value. Consult a CPA for any 1031-exchange or exclusion strategies.

What happens when you inherit a house in Maryland?

The property enters probate unless placed in a trust. The court validates the will, appoints a Personal Representative, and authorizes debt payment and eventual transfer or sale of the home.

Do you have to pay taxes on an inheritance in Maryland?

Only certain heirs pay Maryland inheritance tax; most close relatives are exempt. Distant relatives and non-relatives pay a 10% tax. Capital-gains tax applies only if you sell for more than the stepped-up basis.

What are the legal steps to sell an inherited house in Maryland?

Open probate, obtain Letters of Administration, clear debts, then transfer or sell. The core of any selling inherited property checklist maryland focuses on these legal requirements. An attorney can streamline filings, notices, and accounting so you stay compliant with Maryland law.

Can I sell an inherited house in Maryland without going through probate?

Not if the property is solely in the deceased’s name. Probate is required unless the home was in a revocable living trust, joint tenancy, or had a transfer-on-death deed.

What should I do if there are liens or debts on my inherited Maryland home?

Identify them early and pay from estate funds before distributing proceeds. Title companies will require lien releases at closing; unresolved liens can cancel the sale.

How fast can I sell my inherited house for cash?

As little as 7–21 days after probate letters are issued. Cash buyers—like our team of cash home buyers in Frederick—can close in as little as 7-21 days because no repairs, appraisals, or lender approvals are required.

From Overwhelmed to In Control

You started this journey weighed down by paperwork, uncertainty, and competing advice. By working through this comprehensive selling inherited property checklist maryland guide, you’ve reclaimed clarity and peace of mind. Now it’s time to act.

About Your Guide, Justin Mitchell

As the founder of Maryland Cash Home Buyers, Justin has helped hundreds of families navigate tricky real estate situations like probate and foreclosure. He built the company on a simple principle: to provide sellers with an honest, transparent, and fair cash offer so they can close on their timeline, without the stress. Learn more about Justin and our company.

Further Reading & National Perspectives

While our guide is tailored specifically for Maryland homeowners, it can be helpful to see general advice from national platforms. These tips from Redfin on inherited home sales offer a broad perspective, which can reinforce the universal steps—like clear communication and document gathering—that apply no matter where you live.

What’s Your Next Step? Choose the Path That’s Right for You

Every heir’s situation is unique. Pick the option below that best fits where you are today:

Option 1: For the Planner – Download the Free Checklist

Feel most comfortable with a plan in hand? Download our complete 10-step selling inherited property checklist maryland guide as a printable PDF to track your progress.

Option 2: For Those With Questions – Talk to an Expert

Still have questions about your specific situation? Schedule a free, no-pressure consultation call to get the clarity you need from an expert.

📞 Schedule a Free, No-Obligation Call or simply call Justin directly at (240)-693-5776.

Option 3: For Those Ready for a Solution – Get a Fast Cash Offer

If your priority is a fast, simple, and certain sale, let’s skip the stress. Get a no-obligation cash quote in 24 hours and close on the day of your choice.

Get My Free 24-Hour Cash Quote Now