Last Updated: June 26, 2025

The cash buyer vs realtor maryland decision is a major challenge when you’re coping with the loss of a loved one. The thought of clearing out, fixing up, and listing their house can feel overwhelming. This guide gently walks you through both paths for an inherited property—a traditional listing or a direct cash offer—so you can choose the option that best serves your family’s needs, timeline, and peace of mind. This page specifically compares your two main options, but our comprehensive 2025 guide to selling an inherited house in Maryland covers the entire process from start to finish.

Table of Contents

- Key Takeaways

- Key Terms for Maryland Heirs

- Understanding Your Inherited Property Situation in Maryland

- Quick Video: Cash Buyer vs. Realtor for Inherited MD Homes

- Quick Comparison: Selling an Inherited Maryland House – Cash Buyer vs. Realtor

- Option 1: Selling Your Inherited Maryland House with a Real Estate Agent

- Option 2: Selling Your Inherited Maryland House Directly to a Cash Home Buyer

- Hear From Maryland Homeowners We’ve Helped

- Decision Framework: How to Choose What’s Best for Your Inherited Maryland Property

- Frequently Asked Questions About Selling Inherited Maryland Homes

- About the Author

- Conclusion: Making the Right Choice for Your Maryland Inheritance

- Take the Next Step That’s Right for You

Key Takeaways

- The cash buyer vs realtor maryland decision hinges on priorities: speed and ease versus a potentially higher top-line price.

- Cash buyers can close in 7–21 days, buy as-is, and eliminate showings—ideal when you need funds quickly or want to simplify probate.

- Realtors may achieve a higher sale price, but heirs shoulder 5–6 % commissions, repairs, holding costs, and 60–120 day timelines.

- Always compare net proceeds—what lands in your pocket after every fee, repair, and month of stress.

- Maryland Cash Home Buyers offers transparent, no-obligation cash quotes so you can make a side-by-side, numbers-based decision.

When you inherit a home in Maryland, selling with a Realtor may bring a higher sale price but often takes months, requires repairs, and involves commissions. A direct cash sale to a local buyer like Maryland Cash Home Buyers closes in as little as 7–21 days, needs no repairs, and charges no agent fees, but the offer is discounted for speed and certainty. The best option depends on whether maximizing every dollar or minimizing stress and time is most important to your family.

Key Terms for Maryland Heirs

Understanding the following terms can help you navigate the process of selling an inherited property in Maryland with more confidence:

- Probate

- The court-supervised process that validates a will and authorizes asset transfers. In Maryland, this can add months to an inherited home sale, but alternatives exist to shorten the timeline.

- As-Is Sale

- Selling a property exactly as it stands—no cleaning, repairs, or upgrades required of the seller. This offers significant convenience for heirs.

- Net Proceeds

- The actual cash amount you’ll receive after all selling expenses (like potential agent commissions, repair costs you might have undertaken, closing costs, and any outstanding liens) are paid from the gross sale price. This is the crucial number for your bottom line.

- Fair Market Value (FMV)

- The price a knowledgeable buyer would likely pay, and a knowledgeable seller would likely accept, for a property in its current condition on the open market, with neither party being under undue pressure. This is often the starting point for valuation.

- Step-Up in Basis

- (A valuable potential tax benefit for heirs) An inherited property’s cost basis for tax purposes can “step up” to its fair market value at the date of the original owner’s death. This can significantly reduce or even eliminate capital gains tax if you sell the property. It’s always wise to consult with a tax professional to understand how this applies to your specific situation.

Understanding Your Inherited Property Situation in Maryland

Inherited homes rarely arrive in perfect, move-in condition. Roofs leak after years of deferred maintenance, original kitchens beg for updates, and utilities keep running even while the house sits vacant. Add sibling disagreements, Maryland’s probate paperwork, and the emotional weight of memories—selling quickly can feel impossible.

Common Maryland heir challenges:

- Property condition: Outdated systems, code issues, or hoarder-level clean-outs drive up repair bills.

- Financial pressures: Estate taxes, funeral costs, mortgage payments, or keeping up with utilities drain savings.

- Distance & logistics: Many heirs live hours—or states—away, making coordination costly and stressful.

- Multiple heirs: Differing opinions on price, repairs, and timelines delay decisions and risk straining relationships.

- Probate timeline: Even “simple” estates often take six months or more; faster sales can shorten court oversight and cut holding costs.

Recognizing these realities is the first step in resolving the cash buyer vs realtor maryland dilemma and aligning the decision with your family’s bandwidth and goals.

Quick Video: Cash Buyer vs. Realtor for Inherited MD Homes

To quickly see the main differences in under a minute, watch our explainer on choosing between a cash buyer and a Realtor for your inherited Maryland property:

This 60-second video contrasts timelines, fees, and stress between listing with a Realtor and accepting a direct, as-is cash offer when heirs need to sell a Maryland house.

Cash Buyer vs Realtor Maryland: A Side-by-Side Comparison for Heirs

| Feature | Cash Offer (e.g., Maryland Cash Home Buyers) | Traditional Listing (with a Realtor) |

|---|---|---|

| Time to Close | Typically 7–21 days (flexible) | Average 60–120 days+ after accepting an offer per Rocket Mortgage |

| Repairs Needed | None – sell completely as-is | Usually required to maximize price; heirs manage contractors |

| Showings & Open Houses | One respectful visit | Multiple showings; must keep the home “show-ready” |

| Fees & Commissions | $0 commissions; buyer often covers standard closing costs | 5–6 % agent commission + transfer taxes & seller fees |

| Offer Price Basis | Reflects “as-is” condition & speed (about 55–85 % of after-repair value) | Aims for full FMV—but only if home is market-ready |

| Certainty of Sale | Very high – no loan contingencies | Lower – subject to financing, appraisal, inspections |

| Convenience for Heirs | Extremely high – minimal effort and reduced emotional strain | Lower – weekly tasks, decisions, and negotiations |

| Impact of Condition | Minimal – we buy any condition | Significant – poor condition slashes price or demands repairs |

Option 1: Selling Your Inherited Maryland House with a Real Estate Agent

Pros

- Potentially achieves the highest gross sale price if the home is in great shape or fully renovated.

- MLS exposure attracts many buyers competing in Maryland’s active markets (e.g., Bethesda, Columbia).

- A seasoned agent guides pricing, staging, and paperwork.

Cons

- 5–6 % commission + transfer/recordation tax (~1 %) and seller closing costs.

- Repair & staging costs—heirs typically spend thousands on paint, flooring, landscaping, and junk removal to satisfy buyers and appraisers.

- Showings, inspections, appraisals often uncover new repair demands and can re-open negotiations.

- Longer timeline: 30–60 days on market + 30–60 days escrow = 2–4 months (or more) before funds arrive—holding costs continue meanwhile.

- Uncertainty: Buyers may walk away if financing fails or inspection issues arise, forcing a restart.

In the cash buyer vs realtor maryland comparison, this path is best for heirs who have time, cash for repairs, and want to chase top dollar despite the extra work and risk.

Option 2: Selling Your Inherited Maryland House Directly to a Cash Home Buyer

Pros

- Speed & certainty: Close in as little as a week—ideal for settling estates quickly or stopping accruing expenses.

- No repairs, cleaning, or junk hauling. Leave the furniture, dated appliances, even old paperwork—buyers handle it.

- Zero commissions and we commonly cover standard closing costs, so the offer equals your check (minus mortgages or liens).

- Privacy & simplicity: One brief walkthrough, no public showings, no open-house weekends.

- Works for any condition or title complexity (fire damage, code violations, inherited tenants, liens).

Cons

- Lower gross offer—discount reflects rehab cost, risk, and holding expenses the investor assumes. Typical range: 55–85 % of after-repair FMV.

- Less time to test the open market—though most cash offers stay valid for several days to let you compare.

This option represents the other side of the cash buyer vs realtor maryland choice, ideal for heirs prioritizing speed, certainty, and ease over squeezing every last retail dollar.

Hear From Maryland Homeowners We’ve Helped

★★★★★ (5/5 Stars)

“Hello we had great success selling our Sharpsburg home—it was short and hassle free.” –

Sethian S., Sharpsburg

★★★★★ (5/5 Stars)

“My experience with Justin in Annapolis was fantastic! He bought my house as-is. No repairs, no showings—just a smooth, relaxing process.” –

Bill Adams, Annapolis

These experiences show our commitment to a transparent sale, which is critical when you face the cash buyer vs realtor maryland choice in a sensitive situation like an inheritance.

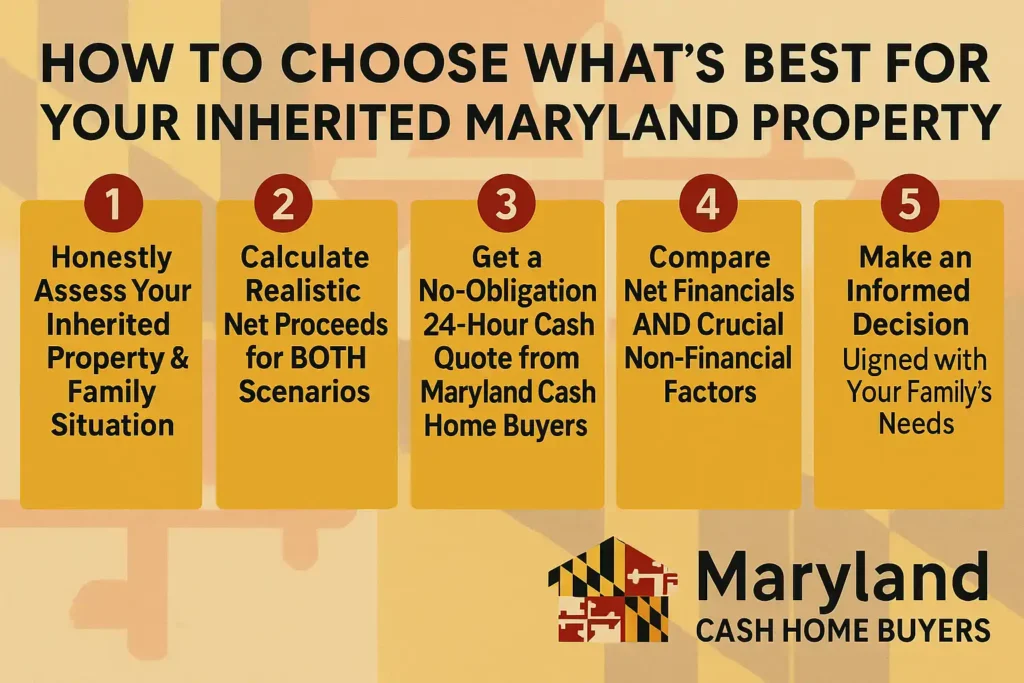

Decision Framework: How to Choose What’s Best for Your Inherited Maryland Property

To solve the cash buyer vs realtor maryland puzzle for your family, follow this simple framework.

HowTo: Deciding Between a Cash Buyer and Realtor for Your Inherited Maryland House

Estimated time: 1–2 hours of research, a few days to gather offers

- Honestly Assess Your Inherited Property & Family Situation. Walk the house (or review photos) and list major repairs. Consider heirs’ timelines, finances, and emotional bandwidth.

Pro-Tip: Video call distant heirs while touring the home to build consensus.

To help with this assessment and guide you through all the necessary tasks, use our comprehensive 10-step checklist for inherited properties. It provides a clear roadmap for everything from securing the property to contacting heirs and consulting with an attorney. - Calculate Realistic Net Proceeds for BOTH Scenarios. For a Realtor sale, estimate repairs, commissions, insurance, taxes, utilities, and mortgage interest for 3–6 months. For a cash sale, subtract nothing—offers are net. The Zillow Closing Cost Guide breaks down typical fees.

Pro-Tip: A simple spreadsheet helps visualize true take-home numbers. - Get a No-Obligation 24-Hour Cash Quote from Maryland Cash Home Buyers. Submit the form or call; we’ll evaluate photos or make a quick visit, then deliver a written offer you can share with co-heirs.

- Compare Net Financials AND Crucial Non-Financial Factors. Put numbers side-by-side, then weigh stress, time, travel, family harmony, and probate deadlines.

- Make an Informed Decision Aligned with Your Family’s Needs. Choose the option that maximizes both dollars and well-being. If a Realtor path feels right, great. If the certainty of a cash sale resonates, we’re here to serve.

Selling an inherited house in Maryland is a big decision. Use this infographic as a visual companion to our guide, walking you through the essential steps of assessing your situation, calculating net proceeds, and weighing your options. Make an informed choice that aligns with your family’s needs.

Frequently Asked Questions About Selling Inherited Maryland Homes

- Why is a cash offer often faster for an inherited house in Maryland?

- Cash buyers use their own funds—no bank appraisals or approvals—so we can close once the title is clear, often within 7–21 days.

- In the cash buyer vs realtor maryland debate, how do net profits really compare?

- A Realtor may list higher, but after 5–6 % commissions, repairs, holding costs, and closing fees, net proceeds can rival—or fall below—a direct cash offer, especially if the house needs work. For tax specifics, see our Maryland inheritance-tax guide.

- What are the emotional benefits of choosing a cash buyer?

- You avoid months of showings, negotiations, and repair hassles, letting your family grieve and move forward sooner.

- If the house needs major repairs, which route is usually better?

- Cash buyers purchase as-is, saving heirs the expense and stress of renovations Realtors often recommend making repairs to attract retail buyers.

- Do I pay Realtor fees when I sell directly to a cash buyer?

- No. Selling to Maryland Cash Home Buyers means zero agent commissions or fees.

- Can you help when several heirs are involved?

- Yes—we routinely coordinate with multiple heirs and estate attorneys to ensure everyone signs comfortably.

- What if the inherited property still has a mortgage?

- This is one of the most pressing financial challenges for heirs. While federal law protects you from the bank demanding an immediate payoff, you are still responsible for making payments to prevent foreclosure. Our detailed 6-step action plan for handling an inherited mortgage provides a clear roadmap, showing you exactly how to contact the lender and manage the debt while deciding whether to sell.

About the Author

Justin Mitchell is a Western & Central Maryland real estate investor who has guided families through probate home sales since 2020. Though not a licensed REALTOR®, Justin partners with Maryland agents, blending investor speed with full broker-level expertise. Meet Justin Mitchell to learn more. Maryland Cash Home Buyers has helped hundreds all over the state.

Conclusion: Making the Right Choice for Your Maryland Inheritance

The “right” way to sell an inherited Maryland home depends entirely on your family’s priorities. The cash buyer vs realtor maryland debate comes down to a simple trade-off: value for time and convenience. If squeezing every retail dollar is worth months of repairs, showings, and uncertainty, a skilled Realtor may be the answer. But if speed, simplicity, and peace of mind matter most, a fair cash offer could resolve the estate in days—not months. Whatever you choose, we hope this guide brings clarity and calm during a difficult season.

Take the Next Step That’s Right for You

Dealing with an inherited property in Maryland can be complex. We’re here to provide clarity and a straightforward solution. Choose the option below that best suits your current needs:

Get Your 24-Hour Cash Quote

Receive a no-obligation, all-cash offer for your Maryland property within 24 hours—no repairs, showings, or agent fees required.

Claim $500 Moving Assistance

We’ll contribute up to $500 toward local moving services when you sell your house directly to us—no hidden strings.

Need More Information First?

Download our complimentary “Maryland Heir’s Guide to Selling Inherited Property,” complete with a checklist.

Want to Discuss Your Specific Situation?

Sometimes a direct conversation is the best way to get answers. Call Justin Mitchell for no-pressure advice tailored to your inherited property.

Talk to Justin: (240) 693-5776

Explore Our In-Depth Resources:

Read our full 2025 Guide to Selling an Inherited House in Maryland.

Selling an inherited home is never just a transaction—it’s a chapter of your family’s story. Whatever decision you make, know that support and straightforward solutions are available. If Maryland Cash Home Buyers can help lighten the load, we’re only a call or click away.