Facing foreclosure in Baltimore is incredibly stressful. The thought of losing your home can be overwhelming, especially with complex legal steps and financial worries. But you’re not alone, and there are ways to take action. This guide is for Baltimore homeowners just like you. It’s a clear, step-by-step plan designed for our city, with local resources and real advice on Baltimore foreclosure. Understanding Baltimore foreclosure can greatly assist in managing your situation.

We know time is critical. Every day matters when you’re facing foreclosure. This guide gives you a step-by-step approach to understand your choices, regain control, and explore every option to keep your home. We’ll explain Maryland’s foreclosure laws, Baltimore’s local help, and how to avoid scams related to Baltimore foreclosure. Whether you’re thinking about changing your loan, a short sale, selling for cash, or working with a real estate agent, we’ll give you the knowledge to make smart decisions.

When dealing with Baltimore foreclosure, it’s crucial to seek immediate support from local resources to enhance your chances of a positive outcome. Familiarizing yourself with the procedures involved in Baltimore foreclosure will give you a clearer perspective on your options.

Understanding Foreclosure in Baltimore

The prevalent issue of Baltimore foreclosure necessitates a thorough understanding of local laws and resources available to homeowners.

Many homeowners are seeking assistance as they navigate the complexities of Baltimore foreclosure. Seeking help early can prevent further complications.

Before we talk about solutions, it’s important to understand how foreclosure works in Baltimore. Maryland, and Baltimore specifically, has its own legal process for dealing with Baltimore foreclosure.

A. Maryland Foreclosure Timeline

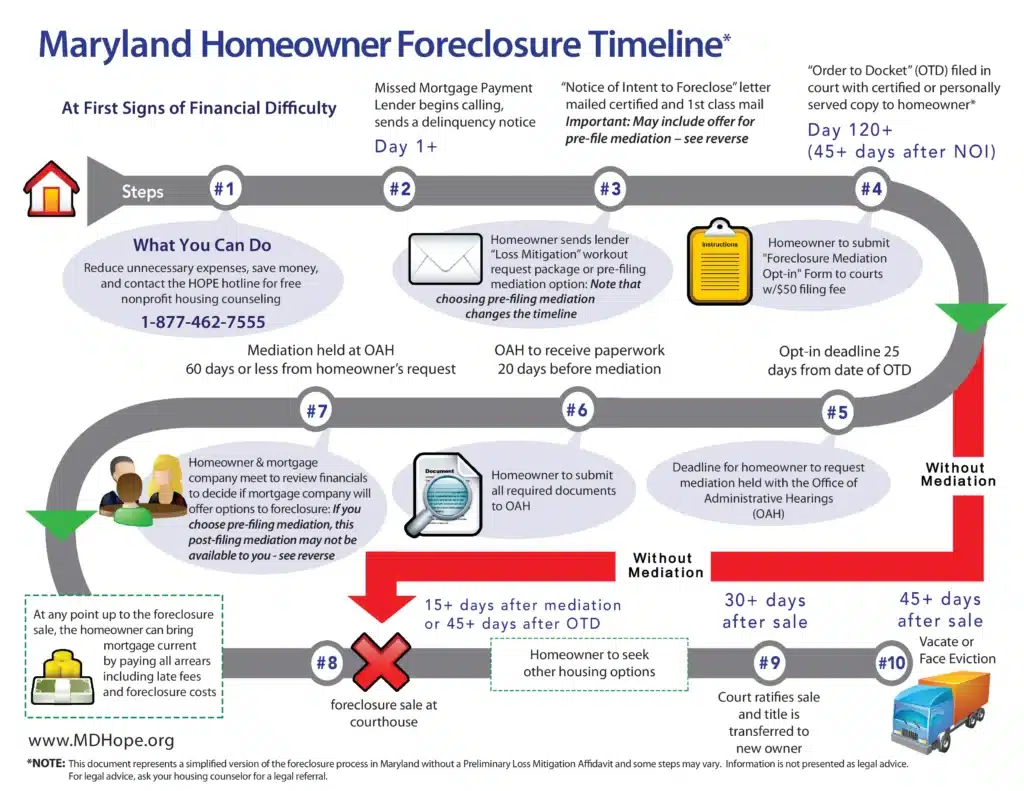

Maryland uses a court process for foreclosure. This means the bank has to sue you in court to take your home. Here’s a simple timeline:

- Missed Payments: Foreclosure usually starts after missing a few mortgage payments, often 3 or 4 months. Keep track of these dates.

- Notice of Intent to Foreclose (NOI): The bank must send you an NOI at least 45 days before starting a court case. This is your first official warning. Pay close attention to this notice. It has important details about your loan and what the bank plans to do. It usually comes by certified mail.

- Help with Your Loan (Loss Mitigation): You have the right to ask the bank for options to avoid foreclosure. This is called “loss mitigation.” You can ask for changes to your loan, like lower payments. You need to apply within a certain time after the NOI. The bank must consider your request.

- Foreclosure Lawsuit: If the bank denies your request for help (or if you don’t ask), they can sue you in Baltimore City Circuit Court to start foreclosure.

- Official Court Papers: You’ll get official court papers (lawsuit). You must respond to this within a certain time (usually 30 days) to protect yourself.

- Foreclosure Sale: If you don’t respond, or if the court agrees with the bank, the court will order a foreclosure sale. Your house will be sold at auction.

- Eviction: After the sale, if you haven’t moved out, the new owner can start eviction to make you leave.

B. Baltimore-Specific Laws and Ordinances

Maryland law sets the basic foreclosure rules, but Baltimore City has some extra rules and resources:

- Baltimore City Vacant Property Registry: If your house becomes empty during foreclosure, it might be put on the city’s vacant property list. This can mean extra fees. Be aware of this if you move out before foreclosure is finished.

- City Funds for Housing (CDBG): Baltimore City gets federal money for housing programs, sometimes for foreclosure help. Ask the city’s housing department about programs that might be available.

- Local Groups: Many groups in Baltimore offer foreclosure help. They often know about local resources and can be very helpful.

C. Homeowner Rights

Understanding Baltimore foreclosure is crucial for homeowners looking to navigate this challenging situation effectively.

Understanding the specific challenges related to Baltimore foreclosure will empower you to make informed decisions.

It’s vital to know your rights if you’re facing foreclosure in Maryland and Baltimore:

- Right to Know: You have the right to get proper notices at each step of foreclosure.

- Right to Fight Back: You have the right to defend yourself in court if you think the bank is wrong.

- Right to Ask for Help: You have the right to apply for options to avoid foreclosure (“loss mitigation”).

- Right to Catch Up: In some cases, you can “reinstate” your loan by paying what you owe, plus fees, to stop foreclosure.

- Right to Pay it Off: In Maryland, you have a short time before the foreclosure sale to “redeem” your home. This means you can pay off the entire loan to get your property back.

- Right to Extra Money: If the foreclosure sale makes more money than you owe, you get the extra money after costs are paid.

Step-by-Step Action Plan

This is your detailed plan to deal with foreclosure in Baltimore.

A. Act Fast: Contact Your Lender

Your first step should be to call your bank as soon as you struggle to make payments. Don’t wait for official notices. Explain your situation honestly and ask about your options. Be ready to share documents about your income, bills, and why you’re having trouble. Keep records of all calls and letters with your bank. Even if it feels scary, talking to them early is key. It can open doors to solutions that might not be available later.

Many individuals facing Baltimore foreclosure are unaware of their rights and available resources.

Familiarizing yourself with Baltimore foreclosure laws can significantly aid homeowners in distress.

B. Gather Your Papers

Understanding the nuances of Baltimore foreclosure can help you take control of your situation.

To explore your options, you’ll need to collect important papers:

- Mortgage Statements: Recent statements showing your loan balance, interest rate, and payments.

- Money Records: Pay stubs, bank statements, tax returns to show your income and bills.

- Explanation Letter: A written explanation of why you’re struggling financially (job loss, illness, etc.). Be clear and honest.

- Bank Letters: Keep copies of all letters and emails from your bank.

- Insurance: Homeowners and flood insurance policies.

Exploring all possible options can make a significant difference when dealing with Baltimore foreclosure.

Knowing your rights in relation to Baltimore foreclosure can empower you during this challenging time.

C. Get Legal and Financial Advice

As you confront the realities of Baltimore foreclosure, stay informed about your legal options.

Foreclosure is complex, legally and financially. It’s best to get help from experts. Legal and financial counselors can give you advice, explain your rights, and guide you through your choices.

- Maryland Legal Aid (Baltimore Office): Maryland Legal Aid offers free legal help to low-income people in civil cases, including foreclosure. Contact their Baltimore office to see if you qualify.

- Baltimore City Housing Counseling: Baltimore City’s housing department funds groups that offer free or low-cost foreclosure counseling. Counselors can review your finances, explore options, and talk to your bank.

- Non-profit Groups: Several non-profits in Baltimore help with foreclosure. These groups understand local resources and can be very helpful.

- HUD-Approved Counselors: The U.S. Department of Housing and Urban Development (HUD) lists approved counseling agencies nationwide, including in Maryland. These agencies meet quality standards and can provide good advice.

D. Explore Your Options

As you work through the steps to address Baltimore foreclosure, don’t hesitate to reach out for assistance.

Implementing a strategy to tackle Baltimore foreclosure requires swift action and clear communication.

The first step when confronting Baltimore foreclosure is to contact your lender immediately.

Don’t put off addressing Baltimore foreclosure; be proactive by engaging with your lender.

Here’s a look at your main options to avoid foreclosure:

- Change Your Loan (Loan Adjustment): This means changing your loan to make payments easier. This could mean a lower interest rate, a longer time to pay, or owing less money.

- How it Works: You apply to your bank to adjust your loan. They review your application.

- Who Can Apply: Rules vary. You usually need to show you have income and can make payments if the loan is changed.

- Good Points: Lower payments, keep your home, avoid foreclosure.

- Bad Points: It can be hard to qualify. You might have a trial payment period. Your loan will take longer to pay off.

- Sell Your House for Less (Short Sale): This is when you sell your house for less than you owe. The bank agrees to accept the sale money for your debt.

- How it Works: Find a buyer and get the bank’s OK for the sale. You’ll need to apply and provide an offer and documents.

- Credit: It hurts your credit, but less than foreclosure.

- Debt Afterwards: In Maryland, banks can sometimes sue you for the debt left over. You might be able to avoid this.

- Good Points: Avoid foreclosure, less credit damage, can move on faster.

- Bad Points: It can be slow, the bank must approve, you might still owe money.

- Give Your House Back (Deed in Lieu): You willingly give your house to the bank to end your mortgage.

- How it Works: You agree to this with the bank.

- What it Means: You lose your house, but avoid foreclosure.

- Good Points: No public foreclosure record, might be less credit damage, faster.

- Bad Points: You lose your house. The bank might still try to collect.

- Sell for Cash (Cash Buyer): Sell your house fast for cash, usually to an investor.

- Good Points: Very fast sale (days), no repairs, no real estate process, quick help with money.

- Bad Points: You’ll get a lower price. Work with a trusted cash buyer!

- How to Find a Good One: Check online reviews, check their reputation, compare offers.

- Reputable Baltimore Cash Buyers: To get a no obligation fast cash offer on your house, from a local Baltimore cash home buyer please click here.

- Work with a Real Estate Agent: An agent who knows about foreclosures can list your house and find buyers.

- Benefits: Might get a higher price, expert help, guidance.

- Finding a Good Agent: Look for agents with foreclosure experience and market knowledge.

E. Decide What to Do

Review your options and get advice. Then, decide. It’s your choice. Think about the pros and cons.

F. Take Action

Once you decide, take action! Apply for a loan change, list your house, or talk to a cash buyer.

G. Get Help Afterwards

Even after foreclosure is resolved, you might need help finding a place to live, managing money, or fixing your credit. Contact local groups or agencies.

Avoiding Foreclosure Scams in Baltimore

Scammers target people facing foreclosure. Watch out for these:

- “Rescue” Scams: They promise to “rescue” you for a fee. They might ask you to sign over your deed or pay for fake help.

- “Equity Theft”: They trick you into taking out loans and steal your home’s value.

- “Rent-Back”: They convince you to rent your house back after “saving” you. You could pay high rent and still lose your home.

How to Spot Real Help

- Be suspicious of guarantees or pressure.

- Never pay upfront fees.

- Check company reviews.

- Get everything in writing.

- Talk to a lawyer or advisor.

Report Fraud

If you’ve been scammed, report it to the Maryland Attorney General and the FTC.

Here’s how to report a scam to the FTC:

- Report Fraud, Scams, and Bad Business Practices:

- Online: Visit ReportFraud.ftc.gov.

- Telephone: Call the Consumer Response Center at 1-877-FTC-HELP (1-877-382-4357).

Resources for Baltimore Homeowners

Here’s where to find help in Baltimore:

- Legal Help:

- Maryland Legal Aid

- Maryland Legal Aid (Baltimore Office):

- While a direct phone number for the Baltimore office was difficult to confirm with 100% certainty, the general contact information for Maryland Legal Aid is:

- Website: https://www.mdlab.org/

- Phone: 410-951-7777 (General Inquiries) You can find the nearest office with this link https://www.mdlab.org/locations/

- While a direct phone number for the Baltimore office was difficult to confirm with 100% certainty, the general contact information for Maryland Legal Aid is:

Conclusion

Foreclosure is hard, but you don’t have to face it alone. Know your rights, explore your options, and get expert help. Act fast, stay strong, and don’t lose hope. Let us help! Contact us for a free review.

In light of Baltimore foreclosure, consider consulting professionals who can guide you through this process.

Resources for assistance during Baltimore foreclosure are readily available and can be invaluable.

Utilizing local resources can greatly enhance your understanding of the Baltimore foreclosure process.

In your quest to avoid Baltimore foreclosure, seek ongoing support and guidance from local agencies.