⏱️ Last Updated: June 26, 2025

Unexpected challenges often arise when dealing with an inherited property in Maryland, particularly the complexities of taxes. Many homeowners find themselves asking: What is inherited property tax Maryland, and how does it affect me? If you’re grappling with this question and confused about whether inheritance or capital gains taxes apply, you’re not alone. This 2025 guide cuts through the confusion, explaining exemptions, deadlines, and the step-up basis to help minimize your tax burden and ensure you keep more of your inheritance. We understand navigating inherited property tax can feel overwhelming during an already difficult time, and we’re here to provide clarity.

This guide is a crucial part of our definitive 2025 guide to selling an inherited house in Maryland. While our main guide covers the entire sales process, this article focuses specifically on the tax-related questions that cause the most stress for heirs.

Need to sell your inherited property quickly to cover taxes, relocation, or other pressing expenses related to inherited property tax? Maryland Cash Home Buyers offers a straightforward, compassionate solution. We provide a fast, fair cash offer, allowing you to sell your house without the stress of repairs, showings, or realtor fees. 👉 Request Your No-Obligation Cash Offer

Key Terms: Understanding Maryland Inheritance Tax & Capital Gains

What is Maryland inheritance tax? In 2025, Maryland’s inheritance tax generally applies at a 10% rate, but only to non-direct relatives. Capital gains tax, on the other hand, applies only to any profit you make after inheriting the property, not its original value.

Probate: The legal process of settling a deceased person’s estate, including validating the will and distributing assets.

Step-up basis: A tax rule that resets the value of inherited property to its fair market value on the date of death.

TOD deed: A Transfer-on-Death deed allows property to pass directly to a named beneficiary without going through probate.

Key Takeaways

- 🏡 Understanding inherited property tax in Maryland is essential for heirs.

- 💵 Capital gains only apply if the home’s value increases after inheritance.

- 📉 A professional time-of-death appraisal may significantly reduce potential capital gains taxes.

- 🧾 The step-up basis has a major impact on Maryland inherited property taxes.

- ✅ Not all heirs owe inheritance taxes—your relationship to the deceased matters.

Table of Contents

- What Is Maryland’s Inheritance Tax in 2025?

- Who Is Exempt From Inheritance Tax?

- Capital Gains on Inherited Property Explained

- Step-Up Basis and How It Affects Maryland Heirs

- Minimizing Your Inherited Property Tax in Maryland: The Appraisal Strategy

- Inheritance vs. Capital Gains: Case Examples

- Do You Need a Lawyer or Tax Pro?

- Limited-Time Moving Assistance Offer

- Maryland Success Stories

- FAQs

- Free 2025 Heir Tax Checklist

- Get Help: Sell Now, Learn More, or Call Us

- About the Author

What Is Maryland’s Inheritance Tax in 2025?

In 2025, Maryland’s inheritance tax is generally 10%—but that rate applies primarily to non-exempt heirs. If you’re a spouse, child, parent, sibling, or grandparent, you’re likely exempt from this tax, which greatly simplifies the process of dealing with inherited property tax in Maryland. Navigating the complexities of inherited property tax Maryland requires understanding these exemptions.

If you inherited a property from a close relative, you likely won’t owe any inheritance tax. However, if the home was left to a more distant relative, friend, or someone without a direct legal familial connection, that 10% tax could apply to the fair market value of the inherited property. Understanding these nuances is crucial when dealing with inherited property tax Maryland.

💡 Tip: Remember, the inheritance tax is the responsibility of the recipient, not the estate itself. This is an important distinction from estate taxes.

Maryland Inheritance Tax Exemptions: Who Qualifies?

Understanding Maryland inherited property tax exemptions is crucial for ensuring you don’t overpay or face unnecessary confusion. Knowing who qualifies for these exemptions can potentially save you a significant amount of money during a difficult time. When it comes to inherited property tax Maryland, knowing the exemptions is key.

- Spouses and domestic partners

- Children, stepchildren, and adopted children

- Parents and stepparents

- Grandparents and grandchildren

- Siblings and their children (nieces/nephews)

Non-relatives or distant relations (like cousins, in-laws, or friends) may be taxed at the full 10% rate. Be aware of this when considering inherited property tax Maryland.

Capital Gains Inherited Property Maryland: What Heirs Need to Know

When you inherit a property in Maryland, you don’t automatically owe capital gains tax. This tax is only triggered if you decide to sell the home for a profit above its inherited value. It’s important to differentiate this from inherited property tax Maryland.

Capital gains on inherited property in Maryland often depend heavily on when you sell and the circumstances surrounding the sale. Here’s a quick breakdown for understanding inherited property tax Maryland and capital gains:

- If you sell the home immediately for its appraised value at the time of death, there’s typically no capital gains tax to worry about.

- If the property appreciates in value before you sell, you’ll owe capital gains on the difference between the inherited value and the selling price. This is separate from any inherited property tax Maryland.

Step-Up Basis and Inherited Property Tax Maryland Heirs Should Understand

The step-up basis is a valuable tax rule that can substantially reduce your tax liability on inherited property. Essentially, it resets the property’s value to its fair market value on the date of death. This is a critical aspect of understanding inherited property tax Maryland.

Example:

- Your aunt originally bought the home for $100,000 back in 1990.

- The property is worth $350,000 when she passes away in 2025.

- Your step-up basis is now $350,000.

- If you later sell the property for $360,000, you only pay capital gains on the $10,000 profit, not the entire difference from the original purchase price. This is because of the rules governing inherited property tax Maryland and the step-up basis.

Understanding how the step-up basis works can save you thousands of dollars in unnecessary tax payments. It’s a critical concept for anyone dealing with capital gains on inherited property in Maryland, and it directly impacts your obligations related to inherited property tax Maryland.

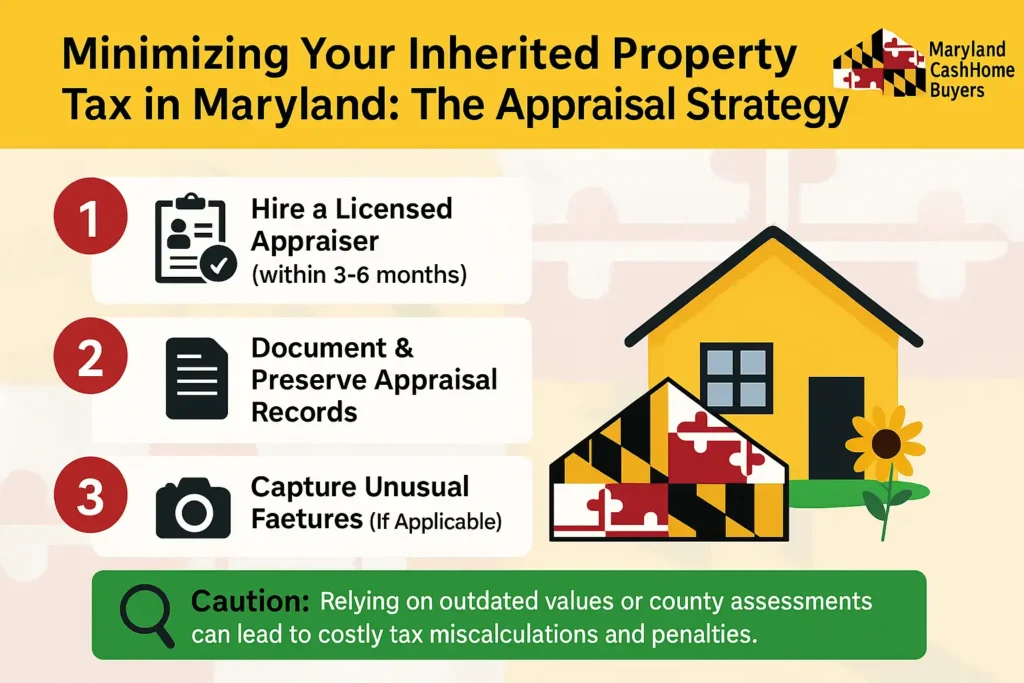

Minimizing Your Inherited Property Tax in Maryland: The Appraisal Strategy

A professional appraisal conducted near the time of death is crucial. It ensures an accurate step-up basis and helps you avoid potentially inflated capital gains down the road. This is a key strategy for minimizing your tax burden.

Step 1: Hire a Licensed Appraiser

Ideally, within 3-6 months of the decedent’s passing, you should hire a licensed appraiser. Their job is to determine the fair market value of the property at the time of death. This is crucial for calculating your tax obligations.

Step 2: Document and Preserve Appraisal Records

Keep all appraisal documents and any comparable sales data in a secure place for your records. These documents are essential for justifying the step-up basis if you’re ever questioned by tax authorities.

Step 3: Document Unusual Features (If Applicable)

If the property has any unusual or unique features that could affect its value, be sure to document them with detailed photographs and descriptions. This provides additional, concrete support for the appraisal’s conclusions.

🔍 Caution: Relying on outdated information or county-assessed values instead of a proper appraisal can lead to costly tax miscalculations and potential penalties related to inherited property tax Maryland.

Inheritance vs. Capital Gains: Case Examples

| Scenario | Heir Relationship | Inheritance Tax? | Capital Gains Tax? |

|---|---|---|---|

| Case 1: Exempt Heir, No Gains | Child (Exempt) | 🟢 None | 🟢 None |

| Case 2: Non-Exempt Heir, Gains Apply | Friend (Non-Exempt) | 🔴 10% on $280K | 🟠 On $40K Profit |

Inherited Property Tax Maryland: Do You Need a Lawyer or Tax Pro?

Navigating inherited property tax in Maryland can be incredibly complex, and it’s easy to make costly mistakes. It’s especially important to understand how capital gains on inherited property may differ significantly from your standard tax obligations. When in doubt about inherited property tax Maryland, seek professional guidance.

Before you decide which professionals to hire, it’s helpful to understand your selling options. Our complete Cash Buyer vs. Realtor guide provides a detailed comparison to help you choose the best path for your situation.

Because of this complexity, we generally recommend working with:

- A local probate attorney (particularly if there are multiple heirs involved or the will is contested)

- A qualified tax advisor familiar with Maryland’s specific estate laws and regulations.

- A cash home buyer if you want to skip repairs and sell fast.

To see how these professional roles fit into the entire sales process, from probate to closing, reference our complete 10-step checklist for selling an inherited Maryland property. It provides a clear roadmap to keep you organized.

Limited-Time Moving Assistance Offer

To ease your transition, we are offering up to $500 toward your local moving costs when you sell your inherited house to us. This offer is for a limited time only and helps you move forward without the financial burden of relocation expenses. Don’t wait—secure your fair cash offer and your moving assistance today.

Here’s how simple it is to claim this offer:

- Request a Cash Offer: Just fill out our quick and easy form to request a no-obligation cash offer.

👉 Get My Cash Offer - Accept & Close: If you accept our fair cash offer, we’ll schedule a closing date that works best for your schedule.

- Transfer the Title: The title will then transfer to Maryland Cash Home Buyers as part of the standard sale process.

- Receive Your Moving Credit: After closing, you’ll receive up to $500 to put toward your local moving services!

This is our way of ensuring your transition is as easy and stress-free as possible—no agent fees, no open houses, no complications. Don’t miss out on this limited-time offer! Especially since understanding inherited property tax Maryland can be complex.

Video: Maryland Inheritance Tax vs. Capital Gains (2025 Explainer)

This short 60-second explainer covers the key differences between Maryland’s inheritance tax and capital gains tax on inherited property. You’ll learn who’s exempt, when these taxes apply, and how a timely appraisal can help you avoid unwelcome surprises. This will help you get a better understanding of inherited property tax Maryland.

Maryland Success Stories

“Needed cash for houses quickly to relocate. Maryland Cash Home Buyers made it happen! Fair offer, no hidden fees, and a smooth process. Thank you!”

– Amon Treck

Read on Google

“Maryland Cash Home Buyers is a game-changer! Sold my distressed property in 21 days. No repairs, no stress—just cash in hand. Thank you, team!”

– Emmah Charlotte

Read on Facebook

FAQs

Who actually has to pay Maryland inheritance tax?

In Maryland, inheritance tax applies only to beneficiaries who aren’t considered “direct relatives.” Spouses, children, parents, grandparents, grandchildren, and siblings are all exempt. All other heirs are generally responsible for paying 10% of the property’s fair market value to the local Register of Wills.

When is the Maryland inheritance tax payment due?

Inheritance tax payments are generally due within nine months of the decedent’s date of death. It’s crucial to plan ahead, as interest and penalties can accrue if the tax isn’t paid on time. Consider selling the property quickly to ensure you meet the deadline.

How is inheritance tax calculated on Maryland real estate?

The tax is calculated as 10% of the inherited property’s fair market value. This value is usually determined by a professional appraisal or state valuation as of the date of death. Exempt heirs don’t pay this tax, but non-exempt heirs are responsible for paying the full amount.

How can I avoid capital gains tax on inherited property in Maryland?

You can potentially reduce or even eliminate capital gains tax by selling the property relatively soon after inheriting it, leveraging the stepped-up basis. This means you’re only taxed on any profit above the fair market value at the time of inheritance, not the original purchase price.

Do I need a lawyer to sell inherited property in Maryland?

While not strictly required, it’s highly recommended, especially if multiple heirs are involved, or the property is currently in probate. A qualified probate attorney can help you avoid costly delays and ensure full compliance with all applicable state laws. Maryland Cash Home Buyers can also streamline the sale for you when navigating these complex situations.

How are capital gains calculated when selling an inherited home in Maryland?

Capital gains are calculated based on the difference between the eventual sale price and the step-up basis (which again, is the fair market value at the date of death). You’re only taxed on the profit above that step-up basis, not the entire sale price.

Is inheritance tax the same as estate tax in Maryland?

Absolutely not. Maryland is one of the few states that levy both. Estate tax is paid by the estate before any distribution to heirs, while inheritance tax is paid by the recipient of the inheritance. Different rules and exemptions apply to each, so understanding the nuances is crucial.

Can Maryland Cash Home Buyers help me avoid taxes on an inherited house?

While we can’t eliminate your tax obligations, we can help you sell the property quickly. This reduces your risk of potential property depreciation or missing crucial tax deadlines. Our entire process is designed to be fast, private, and completely free of required repairs or agent commissions. Contact us to see how we can help.

If you’re feeling unsure about where to begin with inherited property tax in Maryland, don’t hesitate to reach out. We’ve helped numerous Maryland heirs confidently navigate these complex tax decisions, and we’re here to help you too. Contact us today for a free, no-pressure consultation on inherited property tax Maryland.

Free 2025 Heir Tax Checklist (Download)

Before you make any major decisions about selling or paying taxes, download our free, printable checklist. It’s designed to help you stay organized and avoid costly mistakes. Download it to help with inherited property tax Maryland.

👉 Download the 2025 Heir Tax Checklist (PDF)

Ready to Take the Next Step? Explore Your Options.

Ready to Sell Quickly for Cash?

Get a no-obligation cash offer within 24 hours, and close in as little as 7 days. Say goodbye to repairs, showings, and uncertainty! Let us help you with your inherited property tax Maryland concerns.

Not Quite Ready to Sell?

Download our free 2025 Heir Tax Checklist and arm yourself with proven strategies to potentially reduce your tax burden and protect your valuable inheritance. It will help you understand inherited property tax Maryland.

Have Lingering Questions About Maryland Inheritance Tax?

Talk to a knowledgeable Maryland real estate expert right now. We’re here to provide clear answers and guide you through this process with confidence. Call us with your inherited property tax Maryland questions.

About the Author

Justin Mitchell is a Western & Central Maryland real-estate investor specializing in helping families navigate the complexities of probate home sales since 2020. He focuses on minimizing tax burdens and maximizing sale value for inherited properties. If you’re seeking a fast, stress-free way to sell your inherited property, learn more about Justin’s approach here. He is an expert in inherited property tax Maryland.